One of the most common refrains about U.S. trade policy involves low U.S. tariffs. Generally, commenters brag that average U.S. tariffs are just 1.4 or 1.5 percent (depending on the year), among the lowest in the world.

But there are a two problems with that bit of conventional wisdom:

- a small percentage of a big dollar value can still can still be lots of money, and

- the 1.4 percent figure is an average, obscuring some very high tariffs on key products imported from TPP countries.

The first point is rather self-explanatory. Given the choice between 1.4 percent of LeBron James’ earnings and 100 percent of their own earnings, most people (rightly) would choose a small percent of LeBron’s pay without bothering to look it up.

As it relates more directly to trade, John Murphy on Twitter has correctly noted that people who say tariffs are generally low and therefore don’t matter “operate far from business realities, where margins are razor thin for tradeable goods.” Indeed, the U.S. collected about $6 billion in taxes on products imported from TPP countries in 2015 – no small sum for the American companies forced to pay those taxes.

The second point requires a little more explanation. The 1.4 percent average tariff figure includes many imports that face no U.S. tariffs, and therefore do not reflect the tariffs that could be reduced by TPP. Some of the imports face no tariffs because existing free trade agreements (FTAs), such as those with Canada and Mexico. Other products do not face import taxes regardless of where they are made. The duty-free-from-all-countries group includes most high-tech products (e.g., phones, computers), imports by the government, products designed for use by the handicapped, and many other specific products (e.g., coffee beans, industrial diamonds, most toys).

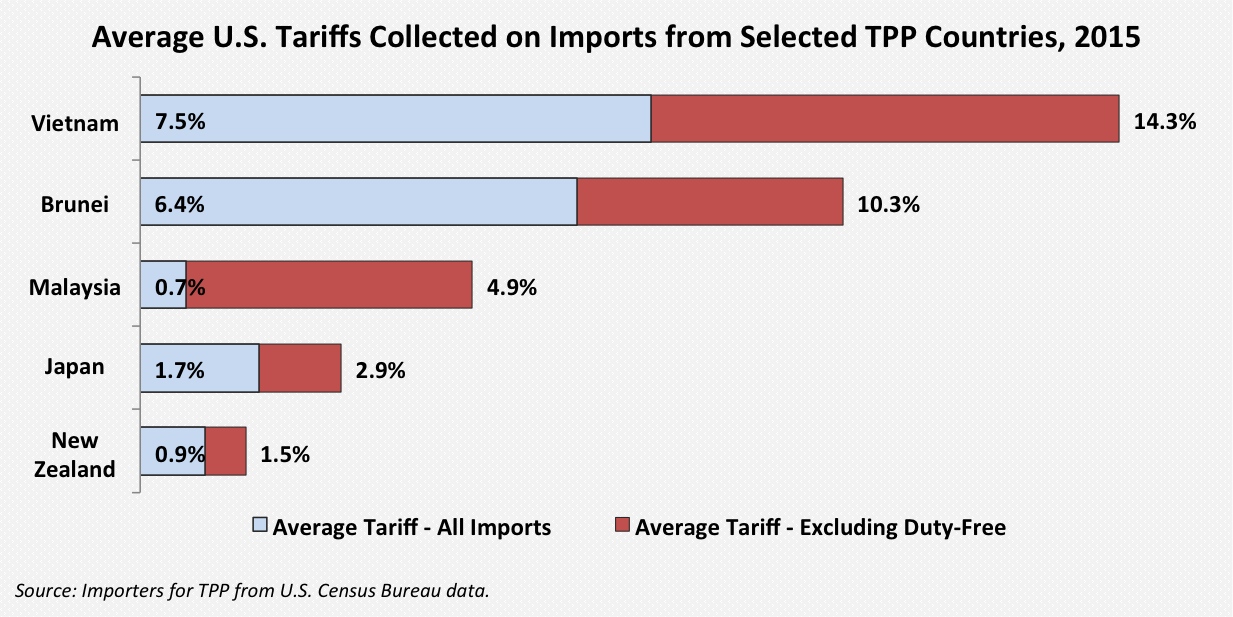

In terms of potential TPP gains, excluding duty-free imports shows that average tariffs for products that actually face tariffs can be quite high. The average U.S. tariff collected on imports from the TPP countries that do not already have an FTA with the United States is about 2.6 percent – and the average tariff for all imports from Vietnam is 7.5 percent. Excluding the duty-free products from those TPP same countries results in an average U.S. tariff of about 5.1 percent. For imports from Vietnam, it jumps to 14.3 percent (see chart above)!

Ultimately, the taxes are paid by the end consumer, whether they are U.S. manufacturers trying to remain competitive in the global marketplace or families trying stretch paychecks as far as possible. So the next time someone mentions “low U.S. tariffs,” keep in mind that individual import taxes are much, much higher for many goods and the TPP represents a major opportunity to reduce them.