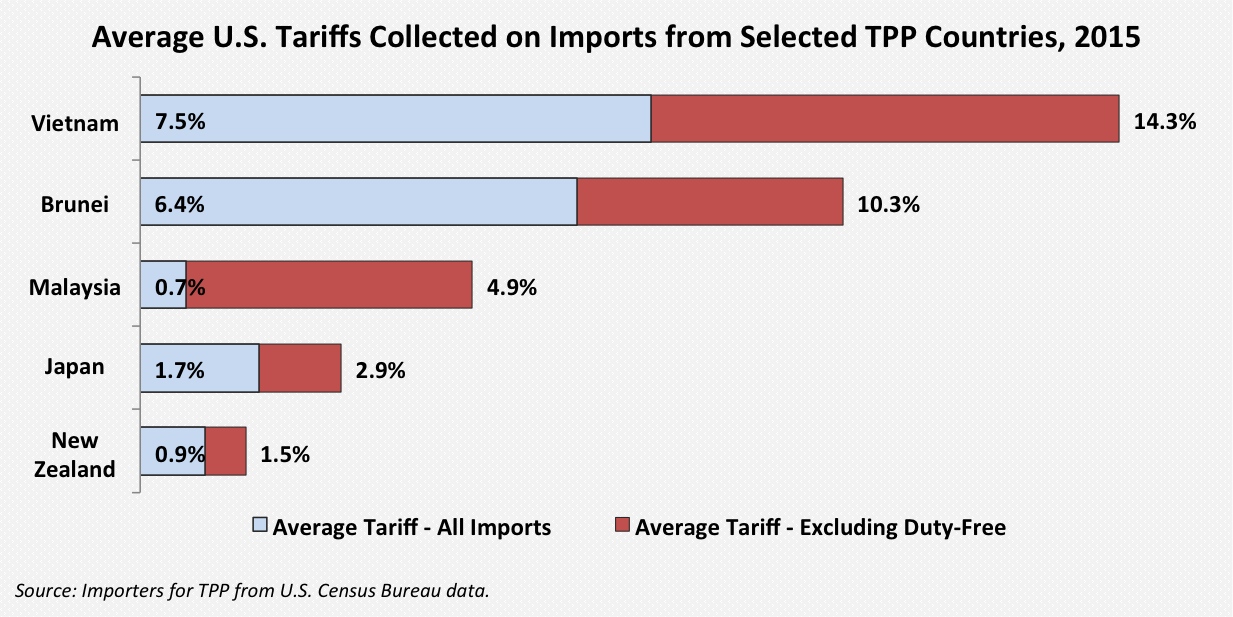

In 2015, U.S. companies paid about $6 billion in tariffs (i.e., import taxes) on products sourced from TPP countries. The vast majority of those tariffs – about $5.4 billion – were assessed on imports from the five TPP countries that have not already negotiated an FTA with the United States (i.e., Brunei, Japan, Malaysia, New Zealand, and Vietnam).

Like any other cost, money paid for import taxes decreases the money available for other priorities such as hiring workers, making capital investments, or increasing marketing efforts to boost sales. And these taxes affect businesses in every state, as shown in the map below of estimated tariffs paid on imports into each state from the five “new” TPP countries.

California faced the most tariffs (about $1.6 billion) by a large margin, but about a third of all states faced at least $100 million in estimated tariffs and another third faced between $10 million and $100 million in estimated tariffs. Only a handful of states faced under $1 million in estimated tariffs.*

Imports into Texas, home state of Ways and Means Chairman Kevin Brady, faced an estimated $278 million in import taxes from the new TPP countries in 2015. Brady recently argued that free trade promotes economic freedom and power by allowing the American consumer to “buy what’s good for our family or business at the price we choose to afford.” Passing the TPP would make prices more affordable for families and businesses, both in Texas and throughout the United States.

* To be clear, states don’t pay or even collect the tariffs; importers pay the tariffs to the federal government. Estimates are based on national data on tariffs collected and the state import data using the Census Bureau’s “state of destination” definition. As such, any overstatement of tariffs paid on imports into a given state (or states) would be offset by understatement of tariffs paid on imports into another state (or states).